The most common kind of private investing is in Mutual Funds (MFs) through an employer provided 401k. Unfortunately, most employer provided 401k plans have extremely limited investing options. These limitations and others, have caused many private investors to seek more investments options through IRA or other trading accounts.

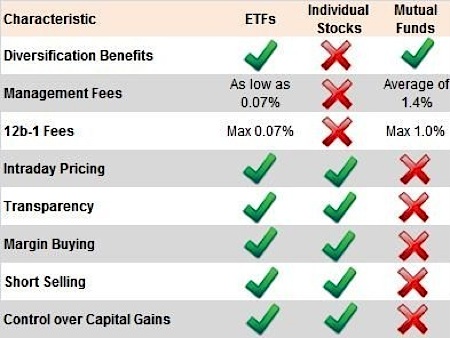

One of the many investment options is ETFs or Exchange Traded Funds. But how do ETFs compare to Mutual Funds? Below are some unique characteristics of each.

Exchange Traded Funds

- ability to sell short

- ability trade on margin

- ability to day trade

- ie trades like a stock

- minimal fees

- tax liability possible even if money is only lost

- no control over capital gains

- fees up to 3% common

- multiple restrictions on how MF can allocate funds: in what and how much they can invest

- the price is not determined until the end of the trading day (no day trading)

Maybe this picture can help as well.

As you can see, ETFs have several advantages over Mutual Funds. As far as I can find, the only disadvantages of ETFs are shared by Mutual Funds.Become a Fan! Follow Me on Twitter

0 comments:

Post a Comment